Bloomberg Interviews Tobina Kahn on Gold’s Record High! April 17, 2024 – Posted in: Press – Tags: Bloomberg, Gold, High, News, Sell

Dear Valued Clients,

Tobina Kahn, President of House of Kahn Estate Jewelers is proud to have been featured in the world-renown, award winning Bloomberg News in an interview on record gold prices this week! We hope you enjoy this informative article below:

At a Brooklyn Pawnshop, Customers Are Flooding In to Sell Gold

– Record prices pushing toward $2,500 an ounce are proving hard to resist

Pictured Above:

Gold at Refined Precious Metal Ltd., London, Source: Bloomberg

By Yvonne Yue Li, Jack Ryan, and Sybilla Gross

Published on April 14, 2024 at 10:00 AM CDT

Investors and metals traders can’t agree on what exactly is behind gold’s recent rally. At King Gold & Pawn in Brooklyn, the customers don’t care. They just want to sell.

For some, sky-high values simply mean it’s a good time to cash in; It’s hard to ignore record prices that climbed above $2,400 an ounce last week. For others, it’s a more desperate move to get money for bills and rent. Whatever the need, what’s clear is jewelers and pawn shops are seeing a flood of sellers.

“People are using gold as an ATM they never had,” said Gene Furman, owner of King Gold & Pawn and Empire Gold Buyers. At Furman’s 5th Avenue store, the number of people coming in selling and pawning gold jewelry is more than three times above normal levels since prices started to rally in late February.

Among them is Branden Sabino, a 30-year-old IT specialist, who sold a gold necklace and a gold ring last week.

“Prices are high, and I need cash,” he said, adding that with the cost of rent, groceries and car insurance rising, he doesn’t have any savings.

The speed and magnitude of gold’s ascent is astonishing — since the 2024 low in mid-February, it has rallied 17%.

Investors typically seek safety in gold for fear of political, economic and financial crises. Escalating tensions in the Middle East, a war in Ukraine, and an upcoming US election are now underlining its traditional role as a haven asset once again. At the same time, some investors have been betting that inflation may stick higher in the long run, underpinning gold’s run.

As experts argue over the causes — economic, political or technical — for Mirsa Vijil, the equation is much simpler: “Gold is high.”

At King Gold, the 55-year-old was pawning a bracelet for gas bills. It was her first time using such a service, but she says she’ll do it again if needed.

Most gold is held by countries — the US alone has more than 8,000 tonnes — but the world is filled with private stashes. For many, the idea of gold conjures up the 400-ounce bars seen in movies such as Goldfinger and British heist comedy The Italian Job.

But dealers sell units as small as 1 gram (about 0.032 of a troy ounce). Then there’s jewelry or coins, bought as gifts, gathered over years by families, handed down through generations.

Pictured Above:

Michael Caine in The Italian Job. Source: Silver Screen Collection/Getty Images

Changing fashions, as well as financial needs, mean there’s often less reason now to pass on old pieces to relatives. And current prices are a tempting offer.

“Young people are not wearing grandma’s jewels. Most of the young people, they want an Apple watch. They don’t want a pocket watch,” said Tobina Kahn, president of House of Kahn Estate Jewelers. “Sentimental is now out the door.”

On Friday, bullion prices for immediate delivery in London rose to a fresh record of $2,431.52 an ounce, after a series of peaks in the past month. It later slipped back to about $2,341.

Right now, much of the demand is coming from Asia and emerging markets, gold watchers say.

Central banks led by China have been scooping up gold at unprecedented levels since 2022 in an effort to diversify away from the dollar reserve system.

Pictured Above:

Tobina Kahn, President of House of Kahn Estate Jewelers in Chicago, Illinois and Palm Beach, Florida

Regular consumers in the Asian nation are buying too, snapping up coins, bars, jewelry — even beans — as well as exchange-traded funds tracking gold and gold mining stocks to hedge against turmoil in the country’s property sector.

It’s a reversal from a historical pattern that’s governed the global trade for decades, where Asian buyers have tended to sell at times of high prices.

In western economies, given the relative economic strength, particularly in the US, “there’s no urgency to buying gold,” said Adrian Ash, director of research at online gold investment service BullionVault. “Gaza, Ukraine, these are just catastrophes. But they’re just not clear and present for western investors right now.”

In recent weeks, BullionVault’s trading platform has seen more than twice as much selling as the year before. “People are very happy to take this price,” Ash said.

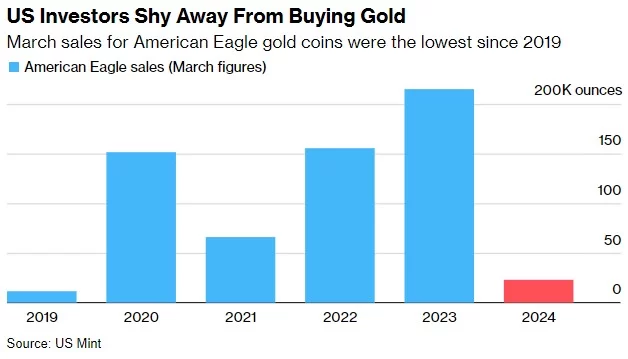

The lack of urgency to own gold is also reflected in weak sales at the US Mint — it recorded the worst March since 2019 for its American Eagle gold coin sales.

Of course, long-term issues such as rising US debt levels and the health of the banking system, as well as worries about inflation, mean some investors want to own the metal regardless of the price.

Jason Collins, director at Gerrards Precious Metals in London’s historic Hatton Garden jewelry quarter, said some of his customers still buy gold due to doubts about banks.

“If suddenly something happened bad in the UK’’ and “the whole banking system collapsed. Your gold in your pocket wouldn’t collapse,” he said.

So, where next for gold? Tobina Kahn has a word of caution for any holders biding their time, hoping it may hit $3,000. Her view is don’t wait.

“It’s very busy and we are getting more calls than ever before about clients wanting to bring in their jewels,’’ she said. “I’m telling the clients to bring them in now, as we are at unprecedented levels.”

Please call or e-mail President Tobina Kahn for more information or to make a complimentary appointment: TobinaJwels@Aol.com | (312)-402-4000

Please feel free to pass this on to your friends and associates.

900 N. Michigan Ave. (Bloomingdale’s Building)

Suite L5-12

Chicago, Illinois 60611

(312)-943-9937

———-

231 Peruvian Avenue (1 Block North of Worth Ave.)

Palm Beach, Florida 33480

(561)-655-3743

Sincerely,

Tobina Kahn

President

House of Kahn Estate Jewelers

(312) 943-9937

Please visit our website at

www.HouseOfKahn.com

Facebook Twitter Pinterest Instagram Youtube

Palm Beach Headquarters

231 Peruvian Avenue

Palm Beach, Florida 33480

(561) 655-3743 Chicago Headquarters

900 N. Michigan Ave.

Suite L5-12

Chicago, Illinois 60611

(312) 943-9937